A Chartered Professional Accountant (CPA) is a professional designation given to accountants in Canada who have demonstrated competent knowledge and skill in accounting. To become a CPA accountants need to complete a series of education requirements, pass a series of standardized exams and gain relevant work experience. CPAs play a key role in financial reporting and advising with duties including accounting auditing taxation and more for individuals and organizations.

Key Takeaways

- Chartered Professional Accountant (CPA) is a designation granted to trained accountants in some countries/regions.

- Becoming a CPA requires obtaining an accounting degree passing certification exams and gaining relevant work experience (usually 1 to 2 years).

- CPAs play important roles in areas like preparing financial statements, handling taxes, auditing companies and providing advisory services to businesses.

- Job duties vary depending on the employer but commonly involve financial reporting compliance budgeting consulting and ensuring the accuracy of accounting records.

- The CPA path takes 2 to 5 years in total after initial education. It signifies competence in domains like accounting, finance taxation and business management.

- Chartered accountancy offers career stability and average salaries range from $50000 to over $150000 for experienced partners at large firms.

- The CPA designation carries high professional Accountant standards and is a respected credential worldwide due to international recognition agreements.

- Technical skills in accounting software communication abilities and strong ethics are crucial for CPAs to properly serve clients and organizations.

Duties and Responsibilities of Chartered Accountants (CAs)

Chartered accountants have many important duties and responsibilities. They prepare financial statements and ensure accuracy. They also complete tax returns for individuals and businesses. CAs analyze financial health and do audits regularly. Audits make sure rules are followed and books are in order. Some CAs offer consulting services to help companies save taxes or plan budgets. They give financial advice to clients.

Chartered accountants play a key role in compliance. Laws and regulations must be understood fully. CAs file important reports to meet compliance standards. They keep clients aware of changes in tax or accounting rules. Guidance is given to remain up to date with requirements. Chartered accountants represent high ethical conduct too. Clients trust them with sensitive financial data.

Job Outlook and Salary for CAs

The job outlook for chartered accountants is very positive overall. Many open positions exist at accounting firms in business and government. Skilled accountants will be needed as the economy and regulations evolve. Automation may change some roles but create new kinds of jobs too in the future. Demand depends on location but opportunities are good in most places.

Starting salaries for chartered accountants are competitive. Pay increases with experience gained on the job. Senior accountants and those who specialize or manage others earn higher wages. According to surveys entry level CAs averaged around $50000 last year. Mid career professionals Accountant make over $80,000 typically. Partners at big firms may earn more than $150,000 working with large clients. Salaries tend to be higher in large cities but living expenses also increase.

Chartered Accountant (CA) vs. Certified Public Accountant (CPA)

Both chartered accountants and certified public accountants complete lengthy studies and exams. Also CAs and CPAs have some important differences. The chartered accountant (CA) designation comes from obtaining membership in certain professional accounting bodies.

Requirements can vary between jurisdictions globally. A certified public accountant refers specifically to certification from the American Institute of CPAs for accountants in the US. While CA and CPA designations represent talented accountants the scope of practice differs by region or country. The main duties of auditing financial reporting and tax preparation apply to both roles.

Also licensed activities may not fully crossover between borders. CAs are recognized worldwide through mutual recognition agreements. CPAs face additional steps to work internationally compared to CAs. Overall both paths create highly qualified finance and accounting advisors.

What’s the Difference Between a Chartered Accountant and a Certified Public Accountant?

The main differences between chartered accountants and CPAs relate to training certification and scope of practice. Chartered accountants train and qualify through chartered institutes in independent nations apart from the USA and Canada. CPAs earn their certification through accountancy boards governed by individual American state laws.

Generally CAs may perform a broader range of services beyond accounting while CPAs work mainly in attest functions. Also scopes do blur with some overlap depending on location. CAs get trained in strategic business advice while CPAs focus expertise in assurance and auditing most commonly. Additionally CAs qualify with any accredited designation accepted by international reciprocity pacts. CPAs must separately certify state by state in America alone.

How do I Become a Chartered Accountant?

The path to becoming a chartered accountant involves education, work experience and exams. A bachelor’s degree specializing in accounting, finance or business is necessary. Some countries accept diploma level degrees as well. Candidates then take foundation courses followed by three levels of exams set by professional Accountant accounting bodies.

During exams subjects like financial reporting management accounting taxation and auditing are tested at each level. Passing all levels can take 2 to 3 years while working full time. Next prospective CAs require 3 to 5 years of approved practical experience in accounting related roles. Mentoring by senior accountants helps develop competencies.

What is the Job Outlook for Accountants and How Much do they Earn?

The job outlook for accountants is very good. Many accounting jobs will be available in the coming years. Businesses always need help with money. Accountants also help follow rules for taxes. Most accountants work full time office hours. Some accountants work for themselves though.

Pay differs based on skills and years of working. Beginning salary averages around $50000 each year. Certified Public Accountants often make more money. People with lots of experience earn over $70000 usually. Top managers and partners at big companies can earn six figures yearly. Pay also depends on where you live and work. Large cities typically pay more but cost more to live in too. Overall accounting offers great rewards for dedicated students.

How to Become a CPA?

First research what it takes to get a license in your state. Requirements vary a bit in each place. Most need a college degree focused on accounting classes. A master’s is a good idea now also. Afterward take the uniform CPA exam with four sections on auditing business taxes and accounting. Study hard as it is not easy to pass all parts.

Then gain work skills. This means working under the supervision of a licensed CPA. States generally require one to two years of full time accounting job experience. Finally apply to get your license. Check details on your state’s board of accountancy website. Pay fees and fill out necessary forms and papers. Congrats you’ll be a CPA.

Research CPA Requirements in your Region

Rules differ a bit between areas for CPAs. Check what your local board requires exactly. Look online for your state board’s site. Find out if a bachelor’s alone suffices or if more education is needed too. See exam section specifics and passing rates. Understand clearly what work experience qualifies. Contact the board with any other unclear points. Knowing all rules in advance prevents delays later. Talk to school advisors also if pieces stay vague. Research ensures your CPA path goes smoothly from the start.

Earn a Bachelor’s Degree and Master’s Degree

A bachelor’s gives your base accounting learning. Most states need 150 credit hours total to take the CPA test. Finish with about 30 hours in accounting like financial cost tax auditing subjects. Plus around 24 credits in general business areas altogether.

Consider majoring in accounting or a related subject like finance. Earning a master’s fulfills education needs for licenses in many places. Opt for an MBA MSAc or MS in accounting for your graduate degree. Advanced classes improve your skills for senior accounting roles.

Complete Experience Requirements

Practical work experience is key to qualifying. Most places need one or two years of full time accounting work under a CPA’s guidance. Part time hours take longer to fulfill. Try getting experience in different parts of accounting like tax auditing financial statements and consulting.

Take detailed notes on your different experiences to share for licensing interviews. Experience verifies competence in handling accounting with CPA credentials. Look for positions at CPA firms during college to begin fulfilling needs early.

Gather Crucial Skills

Certain important skills ready aspiring CPAs. Expertise in technical accounting standards comes through schooling. Oral and written sharing skills let you help clients. Teamwork from group projects aids collaboration in practice. Critical thinking and problem solving conquer complicated scenarios.

Commitment to ethics and honesty builds client trust as a licensed CPA. Comfort using accounting programs boosts productivity. Soft abilities like networking also grow career success greatly. These traits position candidates the strongest for CPA careers. Start developing them through projects, internships and leadership roles right away.

Are you Considering Taking the CPA Exam?

If any part of getting licensed seems overwhelming, creating a study plan may help. Break down requirements and exams into smaller steps. Set target dates for finishing education experience and applying. Aim to take one exam section at a time leaving good preparation time in between.

The research recommended study materials like review classes and question banks. Forming a study group with classmates keeps motivation high. Leaving dedicated hours daily focusing on one topic maintains progress. Stay disciplined yet flexible to change strategies if needed. With early planning and consistent effort ambitious future CPAs can surely reach their goals.

Receive and Maintain Certification

Earning the CPA title takes work. Pass all 4 parts of the CPA exam within 18 months. Gain qualifying experience like 1 to 2 years in auditing or tax fields. Apply to your state board which reviews your work and education. If approved you get licensed.

Then complete continuing education courses each year to renew your license. Staying up to date helps provide top quality services to clients. Maintaining certification proves competence throughout your whole career.

What is a CPA License?

A CPA license allows accountants to legally practice and put their CPA initials after their name. Each state issues licenses through its accounting board. CPA status signifies a professional Accountant has met high standards through education exams experience and ethics. CPA rules differ slightly per state but all aim to protect the public interest. Industries and firms hire CPAs knowing clients can trust their financial guidance meets regulations.

Understanding CPA Salaries | What you Need to Know

Entry level CPAs earn around $50000 while more experienced ones make $75000 to $125000 usually. Those with specialty skills or who manage others may hit $150,000. Large cities and high cost of living areas yield higher wages. Salaries also vary depending on industry firm size and more. Advancement opportunities and earning potential remain excellent for committed CPAs throughout their careers.

Is Insurance Mandatory for CPAs in Canada?

Yes professional Accountant liability insurance coverage is compulsory for CPAs in Canada. This protects clients as well as accountants. Coverage must meet minimum standards set by provincial CPA institutes. Insurance guards CPAs if clients sue over errors or omissions in their work. It covers legal defense costs and any claim amounts. Proof of adequate insurance must be provided regularly for membership maintenance. Coverage lowers risks for all parties involved.

How to Get Accountant Insurance in Canada?

Obtaining insurance requires applying directly to authorized carriers. CPA institutes offer recommendations of approved insurers. Application involves disclosing work details like areas practiced in and clientele types served.

Premium costs depend on experience levels and claim histories. Payments are on an annual basis typically. Coverage can be individual or firm wide group plans according to business needs. Choosing wisely ensures proper protection for established and new practitioners alike.

What is Chartered Professional Accountant Course?

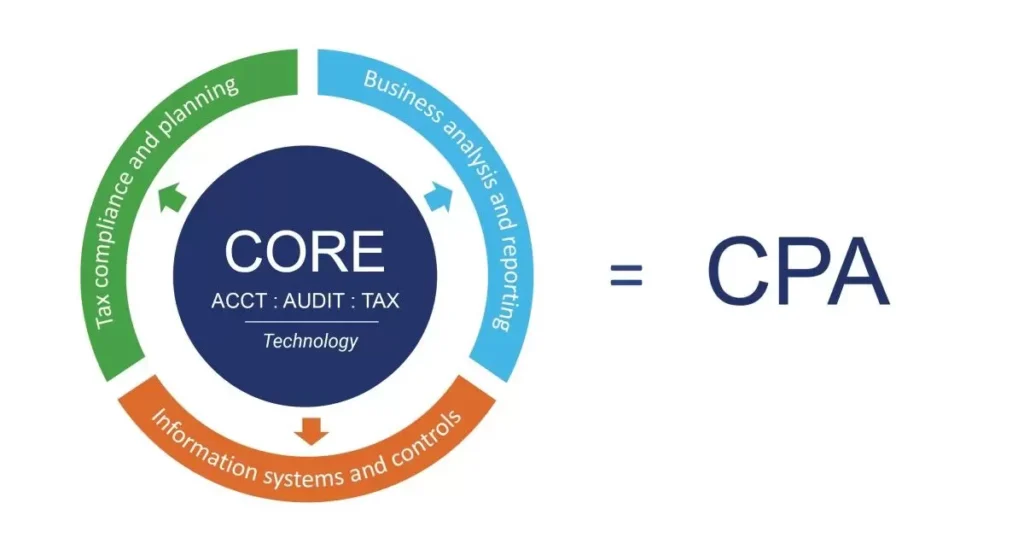

The CPA program prepares students to earn their CPA designation. The course combines academics and hands on training to equip students with expertise in financial reporting management accounting assurance finance and taxation. CPA programs are offered by universities, colleges and institutes across Canada. Core areas and electives provide a well rounded accounting education aligned to entry level CPA competencies.

Course Overview

Programs take 2 to 3 years after a bachelor’s degree to complete. Foundation and Capstone sections integrate theory and case studies. Students also gain practical experience through paid work placements. Upon graduating students are equipped to start CPA certification exams and pursue their designation.

What is a Chartered Professional Accountant’s Job Description?

CPAs work across finance sectors for businesses, government and more. Day to day activities depend on the employer but center around accounting related tasks.

Roles and Responsibilities

Core duties involve preparing financial analysis statements, handling budgets/forecasts, doing audits and ensuring compliance. CPAs provide advice to management, complete taxation services and analyze financial processes. Consultancy roles exist to optimize business strategies as well. Strong problem solving communication and technical skills help CPAs confidently guide smart decisions in their valued positions.

Frequently Asked Questions

Conclusion

Becoming a chartered professional accountant is a challenging path but a very rewarding career choice. One must complete rigorous education, pass difficult exams and gain valuable on the job experience. Also attaining the respected CPA designation as a chartered professional accountant opens up many opportunities to work with diverse clients and industries. It also offers job stability and competitive salaries for those passionate about the finance world. With determination and hard work one can achieve the respected role of a chartered professional accountant.