The FTSE 100 index tracks the performance of the 100 largest blue chip companies listed in the UK. This report analyzes trends and provides insights on the FTSE 100’s movement over a period of time as well as the latest developments in the fast growing financial technology sector.

Blockchains index valuations, sectoral contributions and major company news that shaped the leading stock market index in the past month. Keep reading to get an overview of the UK’s premier market benchmark and emerging fintech industry trends.

Key Takeaways

- The FTSE 100 index tracks the performance of the largest 100 UK listed companies by market value on the London Stock Exchange.

- Fintech refers to technology driven financial innovation in areas like banking payments, wealth management and trading.

- Several fast growing fintech companies have joined the ranks of the FTSE 100 as the sector has boomed in recent years.

- Fintech firms are disrupting traditional financial services through mobile apps and digital platforms for activities like peer to peer payments and digital banking.

- Investing in fintech segments of the FTSE 100 provides exposure to the high growth financial technology space.

- Performance trends in FTSE 100 fintech stocks can provide insights into shifting investor sentiment toward disruptive technologies.

- Fintech companies’ resilience has been tested but many have thrived even during market downturns like the Covid 19 pandemic.

- Key players to watch include payments giants, digital wealth managers and financial technology suppliers enabling new trends.

- Emerging areas like cryptocurrency, artificial intelligence and open banking are influencing fintech investment opportunities.

- Careful stock selection and balancing risks are important when investing in this fast evolving sector.

Navigating the Intersection of Finance and Technology | The FTSE 100 FintechZoom Landscape

The FTSE 100 index tracks the performance of the largest 100 companies listed on the London Stock Exchange. It is one of the most followed stock market indices in the UK. Many technology companies in the financial sector have grown hugely in recent years. These fintech firms are now also included in the FTSE 100. They provide new digital ways for people to do their banking, pay for things, invest and get financial advice.

Fintech companies in the FTSE 100 use the latest technology to change how traditional financial services work. They develop apps and online services for making payments, managing money and trading shares. This disruption by fintech firms affects how all the companies in the index operate.

Understanding the FTSE 100 Index

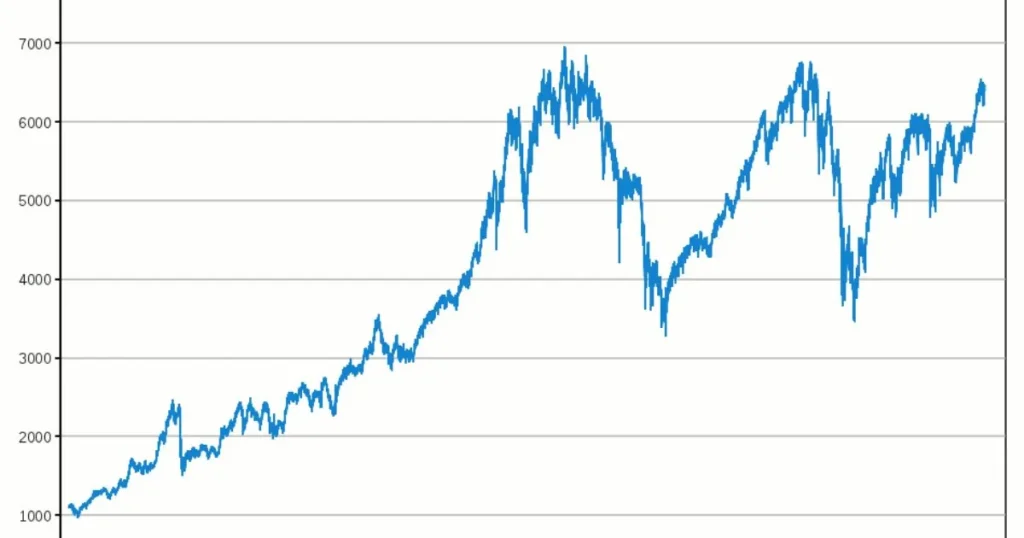

The FTSE 100 index also known as the Financial Times Stock Exchange 100 Index refers to an index of the 100 companies listed on the London Stock Exchange with the highest market capitalization. The FTSE 100 is one of the most widely followed indices for tracking the performance of UK blue chip stocks. The makeup of the index is reviewed quarterly to ensure it still reflects the largest companies on the London Stock Exchange.

The FintechZoom Influence on the FTSE 100

Fintech which is a portmanteau of financial technology describes an emerging industry that uses technology to improve activities in finance. Several fintech companies have grown rapidly and now also feature within the FTSE 100 index. As these firms continue innovating and disrupting traditional financial services their performance and operations will increasingly influence key movements and trends within the broader UK stock market benchmark.

Investment Strategies within the FTSE 100 Fintech Sector

Different strategies can be used when investing within the fintech sector of the FTSE 100 index. Some examples include trend trading certain high growth stocks or adopting a value investing style focused on undervalued companies with upside potential. Analyzing the unique qualities of each approach can help determine the best fit depending on an investor’s goals, risk tolerance and time horizon.

Trend Trading in Fintech Stocks

Trend trading involves identifying stocks demonstrating strong price momentum and riding the trend by establishing long positions. Within fintech trend trading has done well by focusing on payments giants or fast growing digital banking platforms experiencing surging customer adoption rates. Trends can suddenly reverse so tight risk management is crucial when using this momentum based strategy.

Value Investing and Growth Potential

Value investors search for quality companies that seem underpriced according to traditional valuation metrics like price to earnings or price to book ratios. Within FTSE 100 fintech focusing on firms with sound business models and cash flows trading at discounts to intrinsic value despite long term growth opportunities is one approach. Such stocks may outperform if the market eventually recognizes their true worth.

The Impact of Market Trends on Financial Transactions

As financial markets seesaw between gains and losses how people conduct transactions is influenced. Bull markets tend to breed more active investing while volatility fuels demand for hedging tools. Fintech companies flourish by swiftly rolling out digital products attuned to shifting conditions from low cost trading to robust risk management support. Their agility impacts not only clients but also shapes trends circulating throughout the entire FTSE 100.

Real Time Tracking of Stock Prices

Technology enables near instant data aggregation and distribution transforming how stock prices are monitored worldwide. FTSE 100 fintech players at the forefront of this paradigm shift include firms operating financial marketplaces powering trading platforms or supplying pricing analytics tools. By facilitating real time stock tracking they influence every market participant from retail investors to Wall Street giants affecting overall FTSE 100 sentiment and liquidity.

Tech Giants Disrupting Traditional Finance

Some technology behemoths have set their sights on the massive yet antiquated financial services space. By leveraging enormous user bases, artificial intelligence expertise and computational prowess they threaten industry stalwarts unprepared to counter innovation at such scale. While bringing much needed upgrades giant tech entrants expanding financial operations could overhaul the FTSE 100 landscape if incumbents cannot successfully adapt their business models.

Risks and Rewards | The Fintech Sector’s Performance in the FTSE 100

Like all new industry players, fintech companies face risks as well as rewards. On one hand they benefit from exponential growth opportunities by revolutionizing entrenched but rigid sectors. Continuous disruption also means normalized revenues are difficult to achieve and competitive pressures intensify daily. Whether fintech as a whole proves profitable investment wise depends on effectively balancing risk and longevity.

Balancing Risk with Innovation

Innovation often correlates with higher risk. Also fledgling fintech firms enhancing their risk management while branching into steady revenue streams can attain a favorable risk reward ratio over the long haul. This balanced progression suits index investors targeting the FTSE 100’s tech infused future. Careful stock selection focusing on enterprises progressively strengthening moats and mitigating threats facilitates winning on both innovation and risk adjusted returns.

Fintech Companies’ Resilience and Growth

During downturns fintech’s nimbleness in responding to changing needs with digital solutions underpins resilience. Even COVID19 validated their capacity to sustain profitable growth amid uncertainty. Backed by steady cash flows and a catalyst for clients to further embrace tech led finance, high potential FTSE 100 fintech operators uphold optimism overcoming immediate volatility. With resilience bred from disruptive DNA many seem poised for long term outperformance.

Staying Ahead in the Fintech Race | Key Players and Emerging Trends

To stay ahead of the pack in fintech companies must accurately identify the most impactful emerging trends and position themselves accordingly. Within the FTSE 100 index payment facilitators leveraging the blockchain revolution as well as those utilizing AI to deliver personalized financial advice appear well placed for future growth.

Newer entrants like those offering digital banking services fully customized for mobile also show promise. By closely tracking fintech innovations investors can spot potential tomorrow’s leaders within this high growth segment of the UK market.

Who’s in FTSE 100 Fintechzoom?

Fintech features various types of companies ranging from payment facilitators to digital wealth managers. Major FTSE 100 fintech players include PayPal the pioneering online payments platform Sage the leading network for SME accounting software and Experian the multinational credit data corporation investing heavily in new technologies. Meanwhile traditional giants like Lloyds and Barclays also operate fintech subsidiaries central to long term strategies.

Predicting Future Trends FintechZoom

Regarding future trends open banking and using customer data responsibly is set to grow exponentially. This allows comparison sites budgeting tools and personal financial management apps to offer more tailored services.

Cryptocurrencies and digital assets are also forcing financial institutions to provide support and safe access to new investment classes. Lastly further AI 5G and blockchain integration promises to enhance risk analysis faster payments and new digital financial products. Overall innovation and customer centricity will define winning fintech enterprises.

Maximizing Profit | Leveraging FTSE 100 Fintechzoom for Investment Opportunities

Identifying high growth competitively differentiated FTSE 100 fintech firms allows leveraging their upside. Periodically examining solutions markets each target alongside execution track records highlights potential multibaggers. Considering expected consolidation in overcrowded spaces also presents opportunities in acquiring businesses complementing one’s competitive positioning.

Incumbents must transform via aggressive venture partnership initiatives to tap startups and avoid disruption. Overall focusing on scalability profitability and adaptive business models delivers the best risk adjusted returns.

Sectors with Potential Opportunities

Several FTSE 100 fintech sub sectors seem particularly promising. The booming digital payment industry is set for further gains from omnichannel ecommerce acceleration. As budgets tighten demand rises for financial planning/management apps helping individuals achieve savings targets.

Open banking fosters new challengers supporting SMEs with accounting/loan facilities.AI/ML specialists assisting asset managers with investment decisions portfolios are critical to future growth too. Careful stock picking within these high momentum areas could yield sizable upside.

Strategies for Investing in FTSE 100 Fintechzoom

When investing in fintech it’s wise to consider proven industry specialists as well as upcoming disruptors. A blended portfolio approach balancing large established brands with small fast growing startups spreads risks while benefiting from multiple macro trends. Sector thematic ETFs offer low cost diversified access.

| Strategies | Description |

| Stock Picking | Research top fintech performers and identify those with solid fundamentals pricing power and strong management to outperform over time. |

| Index Funds | Low cost index funds track overall fintech segment returns without needing to choose individual stocks and reduces risk. |

| Thematic Funds | Exchange traded funds focused on fintech themes give diversified access to companies revolutionizing payments lending trading etc. |

| Blend Approach | Balance large proven brands and disruptor startups to benefit from established scale and high growth potential of newer innovations. |

| Trend Analysis | Identify emerging trends like AI 5G open banking early to find future leaders shaping financial technology evolution. |

| Dollar Cost Averaging | Invest fixed sums regularly over time into chosen fintech stocks or funds. Avoids bad market timing and benefits from rupee cost averaging. |

| Rebalancing | Adjust portfolio periodically to maintain targeted allocation to each holding. Forces sale of past winners and locks in gains. |

For active stock pickers focusing on variables like competitive edge management pedigree scalable solutions and financial metric trends helps distinguish hidden gems. And rebalancing periodically ensures maximizing returns over market cycles.

FAQs

Conclusion

Analyzing the performance and market trends of fintech companies within the FTSE 100 index provides valuable insights. Examining how these innovative firms in the growing digital finance space have fared over time and responded to changing conditions allows investors to better understand investing opportunities within the FTSE 100 FintechZoom sector. Focusing on the resilient leaders and exploring disruptive emerging trends can help investors make informed decisions.