Fintechzoom is a financial technology platform that allows investors to research and find disruptive startup companies changing the financial services industry. This stock is given as a hypothetical ticker symbol to represent investing in the private company stock of a fintech startup found on the Fintechzoom discovery platform. Investors can use Fintechzoom to track exciting new fintech firms and potentially get access to invest in their early stage funding rounds.

What is Disney Fintechzoom? A Brief Analysis of Walt Disney

Disney FintechZoom is not a specific entity Also it could refer to Disney’s foray into the fintech industry. Disney, known primarily for its entertainment empire, has been exploring opportunities in the financial technology sector. This expansion involves leveraging digital platforms and innovative financial services to enhance customer experiences and streamline business operations.

Disney aims to offer more convenient payment methods, personalized experiences and efficient financial management tools to its vast audience worldwide. This strategic move underscores Disney’s commitment to staying at the forefront of technological advancements while maintaining its position as a global leader in entertainment and media.

Reviewing Fintechzoom Disney Stock and Performance | Latest Media Trends

FintechZoom’s review of Disney stock and performance encompasses the latest media trends surrounding one of the entertainment industry’s giants. With its finger on the pulse of financial markets and media dynamics. FintechZoom provides a concise yet insightful analysis. This review likely delves into Disney’s recent financial performance such as its earnings reports and revenue streams.

It also considers broader media trends influencing the company’s trajectory. From streaming service competition to box office successes FintechZoom likely highlights key factors shaping Disney’s stock performance in a manner accessible to investors and enthusiasts alike.

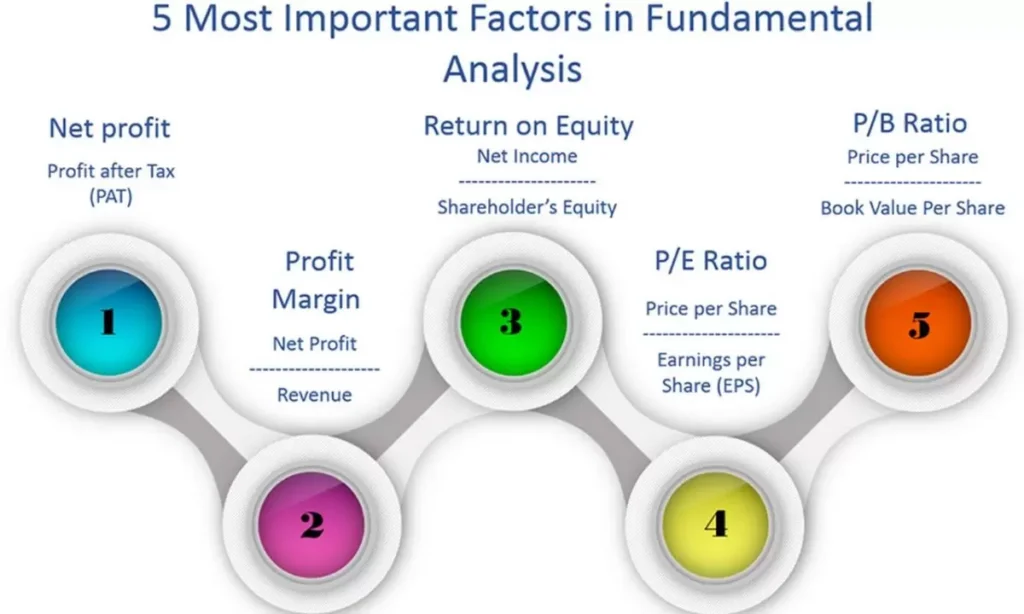

Fundamental Analysis of Dis Stock Fintechzoom

Fundamental analysis of DIS (Walt Disney Company) involves examining the company’s financial statements, management team industry position and competitive advantages to determine its intrinsic value. Key metrics include revenue growth profitability ratios such as return on equity and profit margins and debt levels.

Analysts assess factors like Disney’s brand strength, content pipeline and theme park attendance to gauge its future potential. Fintechzoom provides detailed insights into Disney’s fundamentals aiding investors in making informed decisions based on a comprehensive understanding of the company’s financial health and market position.

Technical Analysis of Dis Stock Fintechzoom

Technical analysis of DIS stock on FintechZoom provides insights into the price movements and trends of Disney’s shares using various indicators and chart patterns. Analysts examine historical price data, trading volume and market sentiment to forecast future price movements.

By identifying support and resistance levels, trends and momentum investors can make informed decisions about buying or selling Disney stock. FintechZoom’s platform offers tools and analysis to help traders navigate the dynamics of DIS stock and capitalize on potential opportunities in the market.

Stepping Into the Cultural Legacy of Disney Stocks

Investing in Disney stocks means stepping into a cultural legacy that spans generations. Founded in 1923 The Walt Disney Company has evolved from a humble animation studio into a global entertainment powerhouse. With iconic characters like Mickey Mouse and beloved franchises like Star Wars and Marvel Disney has captured imaginations worldwide. Disney’s diverse portfolio includes theme parks, media networks and consumer products.

It ensures its influence resonates across various industries. Disney’s consistent innovation and strategic acquisitions have cemented its position as a staple investment for many. Stepping into Disney’s cultural legacy means embracing not only its rich history but also its ongoing impact on global pop culture and entertainment.

Sneak Peek Into Disney Fintechzoom Latest Trends

It offers a sneak peek into the latest trends shaping the industry. From innovative payment solutions to personalized financial services Disney FintechZoom is at the forefront of revolutionizing how consumers interact with their finances.

With a focus on seamless digital experiences and leveraging cutting edge technology Disney FintechZoom is poised to redefine the landscape of financial services bringing magic to everyday transactions. Stay tuned for updates as Disney continues to lead the way in fintech innovation.

Challenges Related to Disney Fintechzoom | Risk Factors Affecting’s Stocks Value

| Step | Challenge Related to Disney FintechZoom | Risk Factors Affecting Stock Value |

| 1 | Streaming Competition | Subscriber Growth Rate |

| 2 | Theme Park Attendance | Revenue Dependence |

| 3 | Content Production Costs | Profit Margins |

| 4 | Economic Downturns | Consumer Spending Patterns |

| 5 | Regulatory Changes | Compliance Costs |

| 6 | Technological Disruptions | Innovation Adoption |

| 7 | Intellectual Property Protection | Piracy and Copyright Infringement |

| 8 | Leadership Changes | Investor Confidence |

Helpful Tips to Invest In Disney Fintech | Dis Fintechzoom Stock Investors

here are four helpful tips for investing in Disney FinTech (DIS) or DIS FintechZoom stock:

Understand the Market

Before investing, research Disney’s venture into FinTech and understand its potential impact on the market. Familiarize yourself with Disney’s FinTech initiatives such as digital payment systems blockchain applications or investment platforms.

Analyze Financials

Dive into Disney’s financial statements paying particular attention to revenue streams related to FinTech. Look for growth trends profitability and potential risks associated with their FinTech ventures. Evaluate how these initiatives contribute to Disney’s overall financial health.

Stay Updated

Stay informed about Disney’s latest developments in FinTech through reliable sources such as financial news websites, company press releases and investor presentations. Monitor regulatory changes and industry trends that could affect Disney’s FinTech initiatives.

Diversify Your Portfolio

Consider Disney FinTech as part of a diversified investment strategy. Don’t put all your eggs in one basket, spread your investments across different sectors and asset classes to reduce risk. Evaluate how Disney FinTech fits into your overall investment goals and portfolio diversification strategy.

Frequently Asked Questions

Conclusion

Fintechzoom Dis stock presents an enticing investment opportunity in the disruptive world of fintech. It has positioned itself as a frontrunner in the market. As investors seek growth potential coupled with stability Fintechzoom Dis stock stands out as a compelling choice. Its strategic positioning and adaptability to changing market dynamics suggest promising returns for those looking to capitalize on the evolving landscape of finance and technology.