Curious about the performance of France’s equity market? Staying up to date with CAC40 FintechZoom insights provides a pulse on the French economy. The CAC40 benchmark tracks the 40 most valuable corporations listed on the Euronext Paris stock exchange across diverse industries including energy, financial services, consumer products and others. Every quarter the Index Oversight Committee evaluates the constituents to ensure recognition of the highest achieving companies.

Key Takeaways

- The CAC 40 index acts as a barometer of the French stock market and economy tracking the country’s 40 largest publicly traded companies.

- Over the past year the CAC 40 has risen over 20% despite challenges from the pandemic driven by strong earnings from companies in sectors like luxury goods banking and energy.

- Technology and healthcare are emerging as influential growth sectors, presenting investment opportunities for forward looking investors.

- Geopolitical events like elections and the economic effects of the war in Ukraine have led to bouts of volatility in the index.

- ETFs that track the CAC 40 provide an easy way for international investors to gain exposure to French blue chips.

- Active stock picking focusing on industry leaders with solid fundamentals can help navigate ups and downs in the index.

- Macroeconomic trends like Europe’s green transition and global economic recovery will be key determinants of the CAC 40’s long term trajectory.

How is it Weighted?

The CAC 40 index calculates the weight of each stock based on its total market value. This means the larger companies make up a greater proportion of the index. LVMH for example usually has one of the highest individual weightings as France’s most valuable business.

Weighting by market cap means the index primarily tracks the overall performance of France’s largest publicly traded corporations. This weighting methodology ensures the CAC 40 smoothly follows changes in the market valuation of its biggest listed companies.

15% Capping

The index adheres to a 15% ceiling policy that restricts the weighting of an individual company to a maximum of 15% of the total benchmark. This regulation prevents any lone corporation from wielding an excessively outsized impact on the overall performance of the index ensuring the benchmark stays diversified and reflective of the wider market.

If a company’s market value surpasses the 15% boundary its allocation in the index is adjusted downwards to conform with the rule. This recalibration can be accomplished by tapering the number of shares of the company integrated into the index computation or applying a multiplier to the company’s stock price.

There are a few things worthy of note about the CAC 40 benchmark:

- The composition of the CAC 40 gets reorganized every quarter to guarantee it accurately mirrors the contemporary condition of the French market. Today’s largest corporations may not be tomorrow’s biggest companies.

- While the CAC 40 provides steadiness it potentially may not represent the optimum choice for investors pursuing high growth opportunities. The index has a relatively smaller emphasis on rapidly expanding sectors like technology compared to some other more expansive benchmarks.

Investors and economic analysts utilize CAC40 FintechZoom insights to assess the output of investment portfolios, collective investment schemes and investment methods.

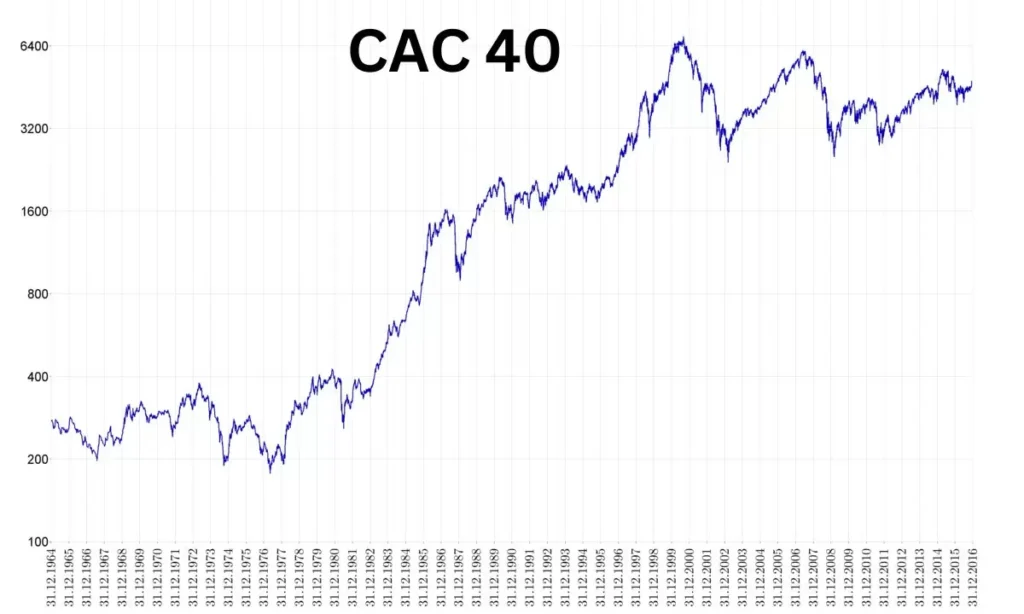

Historical Performance of CAC40 FintechZoom

The French Stock Barometer has seen solid extension over the long haul in spite of times of variability. In the 1980s it consistently ascended as the French economy developed. The record then blasted upward over 150% in the bull market of the 1990s. In any case it lost over half its worth in the worldwide budgetary emergency.

Since 2010 the CAC 40 has trended upward again growing over 140% as France recovered. Tech giants like Airbus and luxury powerhouses like LVMH have helped power gains. Still geopolitical risks like elections and the pandemic have led to downturns.

The index provides insights into how French mega caps have navigated four decades of changing economic conditions. Investors looking for growth opportunities should keep an eye on promising Invest in FintechZoom startups shaking up various industries with new business models and technologies.

Annual Returns

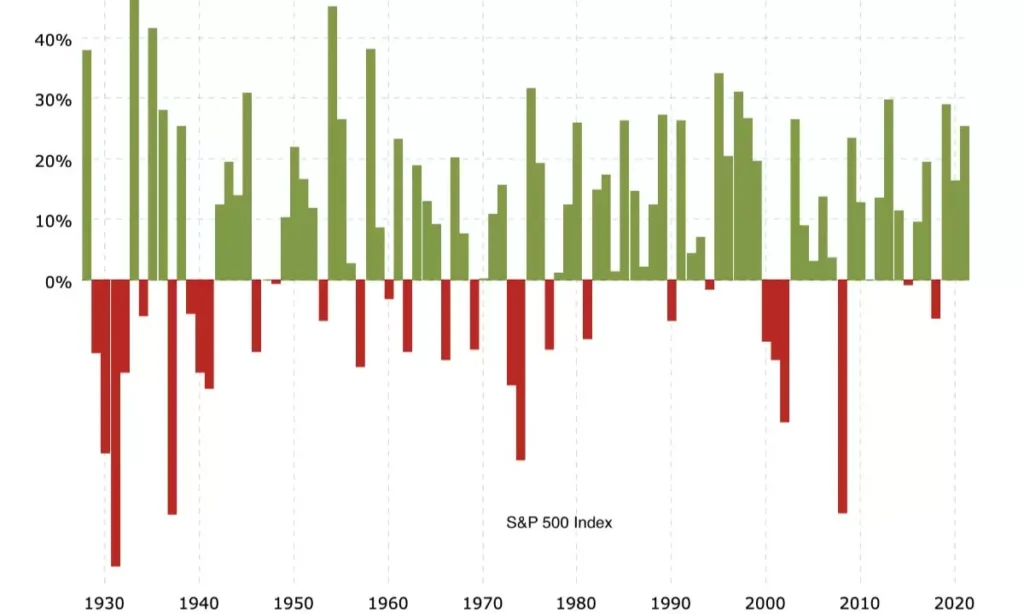

The graphic underneath demonstrates the customary yields of the French Stock Barometer over the latest epochs.

Recently the French Stock Barometer has been impacted by motivations like worldwide financial situations, geopolitical tensions and central bank strategies. French Stock Barometer Financial Innovation Zoom equips you with the apparatuses and insight to stay in front of patterns, dissect information and make educated capital venture choices in the French securities exchange.

Composition of the CAC 40 Index

The French Stock Monitor follows the 40 biggest openly exchanged organizations on the Euronext Paris securities exchange. These organizations speak to roughly 80% of the complete market, an incentive of all French stocks. The makeup of the French Stock Monitor means to mirror the general economy and significant areas in France.

Some of the top companies that make up the French Stock Barometer incorporate large multinational corporations like LVMH, L’Oréal TotalEnergies Sanofi and BNP Paribas. These firms operate across various industries such as luxury goods cosmetics, oil & gas healthcare and banking. Their solid budgetary execution immensely affects the developments of the general file.

Their strong financial performance greatly impacts the movements of the overall index. Investors can keep an eye on these industry leaders and also consider buying CAC 40 exchange traded funds to gain exposure to French blue chip stocks.

The makeup of the French Stock Monitor is surveyed quarterly by the record board. Associations can enter or exit the record subject to market capitalization and business volumes. This ensures that the index constituents remain relevant and continue capturing the French stock market. Changes to the French Stock Monitor rundown aim to give financial specialists an refreshed view of France’s biggest openly exchanged organizations.

Industry Breakdown of the CAC 40 Index

The organizations that make up the French Stock Monitor come from different industry areas of the French economy. The most seriously spoken area is Luxury Goods Textiles and Apparel which incorporates monsters like LVMH and Kerning. Other major sectors include Banks, Oil & Gas, Automobiles and Parts.

The table below provides a brief overview of the industry breakdown of the CAC 40 constituents. It shows the number of companies and their combined weightage in each sector. Investors can gauge which industries currently have the largest exposure through the French stock market benchmark.

| Industry | No. of Companies | Weightage (%) |

| Luxury Goods, Textiles and Apparel | 4 | 21.3% |

| Banks | 4 | 16.2% |

| Oil & Gas | 3 | 12.4% |

| Automobiles and Parts | 3 | 7.2% |

| Health Care | 3 | 7.1% |

Criteria for Selecting Companies in the Index

There are certain eligibility criteria that a company must meet in order to be included in the CAC 40 index. The key criteria are liquidity free float market capitalization and trading volumes on the Euronext Paris stock exchange.

Only large cap companies with strong market presence in France are considered. This acts as a summary, investing guide for investors looking to understand the benchmark and potentially participate in the French equity market through ETFs tracking this premier bourse gauge.

To ensure adequate fluidity a stock’s normal everyday business volumes must surpass 1 million euros over the past 12 months. Moreover no less than 15% of an organization’s offers need to be freely exchanged and accessible to financial specialists.

This ensures constituents will react appropriately to market movements without excessive influence by major shareholders. Meeting these criteria ensures that tracker funds can easily purchase and replicate the performance of CAC 40 stocks.

Fluidity: A pivotal determinant in the choice technique. Associations with higher business volumes and tiger bid ask spreads are favored as they are seen as more fluid and simpler to exchange.

Catalog history: Companies must have been recorded on the Euronext Paris exchange for at least a base time frame ordinarily no less than one year to qualify for incorporation into the French Stock Barometer record.

Local or outsider organizations: Both local French organizations and outsider organizations recorded on the Euronext Paris exchange qualify for incorporation into the file.

CAC40 FintechZoom Recent Trends

- The French Stock Barometer has been encountering staunch unpredictability in 2022 because of different macroeconomic crosswinds. Worry about expansion and ascending loan costs have burdened innovation and development offers. In any case cyclic divisions for example vitality and budgetary administrations have been held up preferable.

- A portion of the key patterns for significant French Stock Barometer stocks incorporate LVMH announcing maintained extravagance interest TotalEnergies profiting from elevated oil costs and BNP Paribas seeing a rebound in speculation banking incomes. Then again L’Oreal and Sanofi looked with difficulties in China’s firm COVID shutdowns affecting deals.

- The file is down over 15% year to date as of June 2022 because of economic slump fears. Nonetheless it has outflanked other European lists and the all the more extensive French market. Seeking after a lot will rely upon how focal banks overseas expansion without pushing economies into a sharp retreat.

- The file is down over 15% year to date as of June 2022 because of economic downturn fears. In any case it has outflanked other European lists and the all the more extensive French market. Seeking after a lot will rely upon how focal banks overseas expansion without pushing economies into a sharp retreat.

- For long haul financial specialists unpredictability presents an opportunity to purchase top notch French Stock Barometer offers at relatively low appraisals. Achievement of late income seasons could see the list resume its bull market over the following 12-18 months. Continuing geopolitical stresses stay a hazard.

FintechZoom’s Holistic Approach to CAC 40 Analysis

FintechZoom provides in depth analysis of the CAC 40 index and its constituent stocks on an ongoing basis. Rather than taking a singular focus their approach examines both business and economic factors to understand trends from a multidimensional lens.

By evaluating metrics such as revenues, profits ESG performance alongside macro data interest rates and global trade their analysts develop a comprehensive view of how external conditions impact revenues. Sector specific insights also shed light on factors driving individual segments.

Through a mix of quantitative research and expert commentary CAC40 FintechZoom Lucid stock helps investors navigate short term volatility and identify long term investment opportunities. Holistic reports present all material insights to support decision making.

By understanding both stock and index level movements through different cycles their analysis aids in weighing risks and returns for active portfolios. Regular updates ensure this powerful French benchmark continues serving as a strategic allocation.

World’s Market Indexes vs. CAC 40

The CAC 40 represents a major developed market like other well known indexes. However as the primary benchmark for France it offers targeted exposure to one of Europe’s largest economies. Compared to broader indexes the CAC 40 has slightly higher weightings to industry sectors driving French growth.

| Index | Country/Region | No. of Constituents | Total Market Cap (US $Bn) | Top 10 Holdings Weightage | Top Sectors by Weight | Trading Currency |

| S&P 500 | United States | 505 | 36,198 | Approx. 30% | Technology, Healthcare, Financials, Communication Services | US Dollar |

| Nifty 50 | India | 50 | 2,725 | Approx. 55% | Financials, Information Technology, Energy, Fast Moving Consumer Goods | Indian Rupee |

| Shanghai Composite | China | Approx. 3000 | 12,131 | N/A | Financials, Industrials, Consumer Discretionary, Healthcare | Chinese Yuan |

| Hang Seng | Hong Kong | 50 | 3,807 | Approx. 60% | Financials, Technology, Consumer Discretionary, Industrials | Hong Kong Dollar |

This provides a more detailed overview of how the CAC 40 compares across various dimensions to major global and regional market benchmarks.

Future Prospect for CAC 40

The CAC 40 faces both opportunities and challenges going forward. As European economies transition away from fossil fuels new sectors supporting green growth could see enlarged weightings. Overall the index remains geared towards profiting from an economic recovery if commodity price pressures ease.

France also aims to digitally transform various industries through its tech startup ecosystem. Maturing businesses listing on the Paris exchange may boost sectors like renewable energy, biotech aerospace and more. This helps diversify the CAC 40 away from its traditional strengths.

By continuing to reflect major wealth creators in France the CAC 40 stands well placed to capitalize on positive cycles. Meanwhile its concentration ensures investors stay exposed to domestic policy support. With a supportive reform agenda the benchmark could enjoy healthy long term gains ahead.

FAQ’s

Conclusion

Analyzing the key trends sectors and macro triggers influencing the CAC40 through FintechZoom’s lens of research is invaluable for investors. Their holistic approach to both short term opportunities and long term strategic allocations associated with the CAC40 index allows investors to benefit from the French market in a simplified manner. FintechZoom’s ongoing analysis of the CAC40 provides critical insights needed to successfully navigate changing markets.